Low fees are paramount for day traders, as frequent transactions can quickly accumulate costs and eat into profits

Deep liquidity enables traders to execute trades quickly with minimal slippage and smooth entry and exit points

It’s important to evaluate an exchange’s security measures and track record before commencing trading

Choosing the best crypto exchange is vital if you want to maximize your day trading endeavors. In this guide, we’ll tell you about the main factors to consider when weighing up an exchange.

Day trading is the 100 meter dash of the investing world, contested over the short course rather than the long. With the ability to capitalize on short-term price movements, skilled day traders can seize opportunities for substantial profits, whatever commodity they’re trading.

In the case of crypto day trading, one’s success depends on many different factors – one naturally being the choice of exchange platform on which trades are conducted. After all, venues offer their own terms, supported assets, withdrawal limits, trading fees, and so on. All else being equal, two day traders operating on different platforms but making the same trades can end up with very different balances.

Finding the best crypto exchange for day trading is therefore essential if you want to maximize your investing endeavors and ensure a seamless and efficient trading experience. In this article, we’ll tell you about the main factors to consider when choosing the right crypto exchange.

First and foremost, consider the security measures in place. Strong security measures are crucial to protect your investments and personal information. Look for exchanges that offer robust security measures such as two-factor authentication, cold storage, and encryption protocols. These features ensure that your digital assets are safeguarded against potential threats.

In addition to basic security measures, some exchanges provide insurance for user funds, adding an extra layer of protection. This is particularly important in the crypto market, where security breaches and hacking attempts are not uncommon. Ensuring that your chosen exchange prioritizes security will give you peace of mind and allow you to focus on your trading strategies without worrying about the safety of your assets.

Next, evaluate the trading fees. Low trading fees can significantly impact your overall profitability. Look for exchanges that offer relatively low fees and have a competitive fee structure. This includes considering spot trading fees, crypto withdrawal fees, and fiat deposit fees. By minimizing these costs, you can maximize your returns on each trade.

Some exchanges offer discounts for high-volume traders or for using the platform’s native token to pay for fees. Understanding the fee structure in detail will help you choose an exchange that aligns with your trading volume and strategy. Always compare the fees across different exchanges to ensure you’re not overpaying and that your trading activities remain profitable.

The availability of advanced trading tools and features can greatly enhance your trading experience. Advanced charting tools, trading signals, and automated trading options provide you with the necessary resources to make informed decisions. These tools help you analyze market trends, execute trades efficiently, and manage risk effectively.

For advanced traders, features like margin trading, futures trading, and options trading can open up additional avenues for profit. Breakout Prop, for example, offers a range of advanced trading tools and features that cater to both novice and experienced traders. Utilizing these tools effectively can give you a significant edge in the fast-paced world of crypto day trading.

A user-friendly interface is another critical factor. An intuitive interface ensures that you can navigate the platform easily and execute trades without unnecessary complications. A user-friendly platform with a clear layout and responsive design makes day trading more efficient and enjoyable.

High liquidity means you can enter and exit positions quickly without significant price slippage. This is particularly important for day traders who rely on short-term price movements. Ensure the exchange you choose has sufficient trading volume to support your strategies.

Lastly, consider the range of supported assets. The best crypto exchange should offer a wide variety of trading pairs, allowing you to diversify your portfolio and take advantage of different market opportunities. Whether you’re interested in major cryptocurrencies or niche altcoins, having access to a broad selection of digital assets is advantageous.

A diverse portfolio can help mitigate risk and provide more trading opportunities. Breakout Prop supports over 70 digital assets, giving traders ample choice to build a balanced and diversified portfolio. This flexibility allows traders to adjust their strategies based on market conditions and individual preferences.

There is no shortage of crypto exchanges willing to take traders’ action, just as there is no shortage of digital assets to trade. With this in mind, you have to be as smart about your selection of exchange as your trading strategies. Crypto day trading demands precision, and the choice of the right crypto exchange can significantly impact your success.

Low trading fees are key for day traders, as frequent transactions can quickly accumulate costs and eat into potential profits. Evaluate the fee structure of the exchange, considering maker and taker fees as well as any discounts or incentives for high-volume traders. Some exchanges offer relatively low fees, making them more attractive to traders looking to maximize their gains.

Deep liquidity is the lifeblood of a successful trading platform, as it enables traders to execute trades quickly with minimal slippage and smooth entry and exit points. Exchanges with high liquidity across various trading pairs are preferable for crypto traders, ensuring that they can take advantage of market movements without significant delays.

A user-friendly interface and robust technical infrastructure are vital. Choose an exchange (or exchanges) that boast quality matching engines, intuitive interfaces, and advanced charting tools. A user-friendly platform with an intuitive interface allows day traders to execute trades efficiently and make informed decisions based on real-time data.

Customer support isn’t a given in the crypto world, where many teams are anonymous or pseudonymous, with no physical headquarters to speak of. With trading, customer support can be invaluable – especially during times of market volatility or technical turbulence. Ensure the exchange provides reliable customer support to assist with any issues that may arise.

Advanced trading tools, such as APIs that let users execute more sophisticated trades or connect to automated trading platforms or arbitrage scanners, are offered by many top crypto exchanges. Moreover, the number of trading products (margin trading, futures, leverage, etc.) differs between venues. Make sure you opt for a platform offering a diverse range of tools and products that align with your strategies.

Just because you want to trade an extremely obscure token doesn’t mean any exchange will furnish your request. While the majority of modern exchanges support an extensive list of trading pairs, be sure to trade on exchanges that offer the assets you wish to trade. This flexibility allows you to diversify your portfolio and explore various trading opportunities.

Whether you support KYC or believe it’s an attack on your right to privacy is irrelevant. Familiarize yourself with its deposit and withdrawal limits, and any potential restrictions that might impact your trading activities. Some exchanges have stringent KYC procedures, while others offer more lenient options, allowing you to choose based on your preferences.

Evaluate the exchange’s security measures, track record, and reputation to ensure the safety of your funds. Strong security measures, such as two-factor authentication, cold storage, and encryption protocols, are essential to protect your digital assets.

Some exchanges offer insurance or protection for user funds, providing peace of mind in the event that an exchange suffers a hack. This additional layer of security can be a significant factor in your decision-making process, ensuring that your investments are safeguarded against potential threats.

Selecting the best crypto exchange for day trading involves evaluating multiple factors, including trading fees, liquidity depth, technical infrastructure, customer support, advanced tools, asset variety, KYC requirements, security measures, and insurance for user funds. By carefully considering these elements, you can optimize your trading strategies and enhance your overall trading experience. Making an informed choice will allow you to capitalize on market opportunities and achieve success in the dynamic world of crypto day trading.

Prop trading, where a firm or brokerage grants starting capital to traders to fund their trading strategies in return for a percentage of their profits, has become increasingly popular among day traders. This model is particularly appealing to traders who have confidence in their abilities but lack the necessary capital to get started. Breakout Prop is an exemplary example of a crypto-native prop trading platform that ticks many of the important boxes for successful day trading. If you’re interested in exploring various crypto day trading strategies, Breakout provides a comprehensive environment to develop and refine your approach.

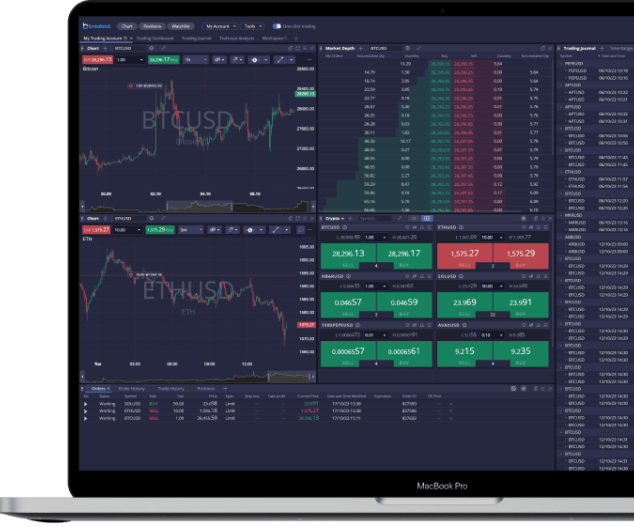

Breakout leverages liquidity from a Tier 1 centralized exchange, giving traders access to a broad, deep market. This is crucial for day traders who rely on margin trading to amplify their positions and potential profits. Margin trading allows traders to borrow funds to increase their trading volume, which can lead to higher returns on successful trades. With Breakout, day traders can utilize margin trading to take advantage of market trends and short-term price movements effectively.

Margin trading on Breakout is facilitated by advanced trading tools and a user-friendly platform that supports over 100 digital assets. The platform is notable for its tight spreads, visible order book depth, and built-in risk management features.

These elements are essential for day traders who need to execute trades quickly and efficiently while managing their risk exposure. Breakout Prop also provides a competitive fee structure and relatively low fees, making it an attractive choice for traders looking to maximize their profits through margin trading.

Trading volume is a critical factor in day trading, as it indicates the liquidity and activity level of a particular asset or market. High trading volume ensures that traders can enter and exit positions quickly without significant price slippage.

Breakout excels in providing high liquidity, allowing traders to execute trades smoothly and take advantage of market movements. This is particularly important for crypto day trading, where market volatility can create numerous trading opportunities.

Breakout supports a diverse range of trading pairs, ensuring that traders have access to various assets and can diversify their portfolios. The platform’s advanced charting tools and trading signals help traders analyze market trends and make informed decisions. These tools, combined with Breakout’s competitive fee structure and low trading fees, enable traders to increase their trading volume and optimize their strategies.

Breakout is designed to cater to many different types of crypto traders, including day traders. The platform supports over 100 digital assets with the best available perpetual futures liquidity. This extensive support ensures that traders can find and trade the assets they are most interested in, further enhancing their trading experience.

To get started with Breakout, prop traders need to pass an Evaluation phase. This phase assesses their trading strategies and performance, ensuring that only skilled traders move on to the live funded accounts.

Once traders pass this evaluation, they can trade with their live funded account and keep up to 90% of the profits generated—a handsome rate among prop trading platforms. This incentive structure encourages traders to perform at their best and aligns their interests with those of the platform.

Breakout prides itself on offering the best spreads and execution in crypto prop trading, as well as the fastest payouts. Traders can receive payouts just one day after getting funded and every seven days thereafter. This rapid payout schedule provides traders with quick access to their earnings, enhancing their cash flow and enabling them to reinvest their profits into further trading activities.

Breakout stands out as a premier choice for day traders looking to maximize their trading volume and leverage margin trading for higher returns. The platform’s high liquidity, advanced trading tools, user-friendly interface, and competitive fee structure create an ideal environment for successful day trading. By providing access to a broad range of digital assets and offering attractive profit-sharing and payout terms, Breakout empowers traders to achieve their financial goals and succeed in the dynamic world of crypto day trading.

You might be the best crypto day trader the world’s ever seen, but unless you spend a bit of time finding the best exchange platform, you’re doing yourself a disservice. By carefully evaluating factors like trading fees, liquidity depth, user interface, customer support, trading tools, and security, you can ensure a seamless and efficient experience. Platforms like Breakout exemplify the qualities that crypto day traders should seek, offering deep liquidity, advanced trading tools, and a transparent and fair prop trading environment.

Margin trading is a powerful tool in the arsenal of any crypto day trader. It allows you to borrow funds to increase your trading volume, amplifying both potential gains and losses. Breakout is particularly well-suited for margin trading, providing traders with access to significant liquidity and advanced trading tools. By leveraging margin trading, day traders can capitalize on market movements and short-term price movements more effectively.

Trading volume is a critical factor in the success of any day trading strategy. High trading volume indicates a liquid market, where traders can buy and sell assets quickly without significant price slippage. Breakout excels in this area, offering high liquidity across a wide range of trading pairs. This ensures that traders can execute trades smoothly and take advantage of market trends.

The platform’s advanced charting tools and technical analysis capabilities enable traders to make informed decisions based on market trends and trading signals. By analyzing market movements and utilizing technical analysis tools, traders can identify profitable trading opportunities and optimize their strategies. Breakout’s comprehensive suite of trading tools, including advanced charting tools and trading signals, empowers traders to stay ahead of the market.

In addition to its trading tools, Breakout’ secure trading environment and robust security measures ensure the safety of user funds. The platform’s commitment to regulatory compliance and transparency builds trust with its users, providing a reliable and secure trading experience. With features like low fees and relatively low fees, Breakout Prop makes it easy for traders to maximize their profitability.

Breakout stands out as an exemplary platform for crypto day traders. Its deep liquidity, advanced trading tools, and transparent prop trading environment make it an ideal choice for traders looking to maximize their profits. The platform supports over 100 digital assets, providing a wide range of trading pairs for traders to explore. This diversity ensures that traders can find the assets that best suit their strategies and capitalize on market opportunities.

The platform’s focus on user-friendly design and an intuitive interface makes it accessible to traders of all experience levels. Whether you’re a seasoned trader or just starting, Breakout offers the tools and resources you need to succeed. The platform’s commitment to providing the best crypto exchange experience is evident in its features, including advanced trading tools, automated trading options, and a secure trading environment.

In conclusion, choosing the right crypto exchange is crucial for the success of any day trading strategy. Platforms like Breakout offer the features and tools needed to thrive in the fast-paced world of crypto day trading.

By carefully evaluating factors such as trading fees, liquidity depth, margin trading options, and trading volume, traders can find the best crypto exchange to meet their needs. Breakout’s comprehensive suite of features and commitment transparency make it a top choice for crypto day traders looking to maximize their profitability and achieve their trading goals.